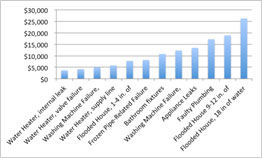

Water damage is one of the most common reasons people make claims on their home insurance. Burst pipes, leaky appliances and flooded basements often lead people to discover the details of their home insurance policies.

home insurance for water damage”Water damage and homeowners policies can be a volatile issue in many ways,” says Don Griffin, vice president of personal lines at the Property Casualty Insurers Association of America, a trade group. “Generally, the damage caused by water will be covered, but whatever causes the damage — say, a leaking dishwasher hose — may not be.”

Although insurance companies may pay to replace a carpet damaged by your dishwasher leak, you probably have to replace or repair the hose at your own cost. If a sudden, unforeseen problem such as a frozen pipe leads to water damage, your home insurance covers repairs to both the broken pipe and your home and furnishings.

Here are common water-damage scenarios and their insurance consequences.

Scenario No. 1: The temperature drops to 10 below zero, causing your water pipes to freeze and burst. Your floor is now covered in 6 inches of water.

Are you covered? Yes, you’re covered for water damage from burst pipes, but most policies won’t cover you if you’ve left the house unoccupied and without heat. If that’s the case, your claim could be denied because you’ve failed to perform the necessary upkeep that would prevent the accident.

Scenario No. 2: Water leaks from your backyard pool, ruining your manicured lawn and flooding your basement

Are you covered? The damage to your basement and your personal property are covered, but not the damage to your lawn. According to a sample policy, “We do not cover land, including land on which the dwelling is located.” However, your lawn is covered if it’s damaged by certain “named perils.” These include fire, explosion, riot, aircraft, vehicles not owned by you and vandalism. The amount of coverage for lawns and plants is small — usually only up to $500. Swimming-pool leaks are not a named peril. But if your leak was caused by a tree falling on the pool, it would be covered.

Scenario No. 3: Your washing machine overflows, flooding the basement.

Are you covered? Yes. But it depends on your home insurance company view of the problem: Did you fail to maintain the washer properly or did sudden, accidental damage cause the flood?

“Most of the time, if an appliance breaks and water goes all over, insurance covers it. In the case of a washing machine, you might need to purchase replacement parts out of your own pocket because they were not maintained correctly, but the damage to your basement is covered,” says Griffin.

Scenario No. 4: A sewer backs up, flooding your basement.

Are you covered? No. Standard home insurance policies don’t cover sewer backups, and many specifically exclude damage from sewer back-ups. Special endorsements are available, at added cost, for sewers and drains.

Tip

Don’t shoot yourself in the foot by reporting damage to your home insurance company that’s not covered by your policy. Your damage report may still go on your insurance record and look like a claim when you shop for new insurance in the future. Read how one five-minute call to your insurance company can dog you for seven years.

Scenario No. 5: Water seeps from the ground into your basement, damaging your foundation and interior.

Are you covered? No. Seepage is considered a maintenance problem, not “sudden and accidental” damage, and is excluded from home insurance coverage.

Scenario No. 6: During a heavy rainstorm, water leaks through your roof. The roof is damaged, as is furniture.

Are you covered? Somewhat. You’re unlikely to be reimbursed for roof repairs because that’s a house-maintenance issue. But the water damage to your home is covered. Damage to your furniture is also likely covered if you have a standard H0-3 home insurance policy, but not if you have a generic HO-1 policy (which many insurers don’t even sell anymore).

If your neighbor’s tree falls on your roof, the damage to your roof, home and belongings is covered. Your policy also reimburses you up to a certain amount, usually around $500, for the cost of removing the tree.

Scenario No. 7: A nearby lake or river overflows its banks, causing a flash flood in your living room.

Are you covered? No. Flood damage is not covered by home insurance. You must purchase flood insurance for that. You can purchase flood insurance as long as your community participates in the National Flood Insurance Program.